Risk

Actively managing risk with the mission to achieve superior risk-adjusted returns for our investors.

Managing risk is a key advantage at Patronus. Our mitigation techniques are not only intended to reduce daily variance, but also strive to ensure investor capital is secure on tail events. Actively managing the risk increases Patronus Partners' probability of achieving superior risk adjusted returns for our investors whilst safeguarding their capital.

*Past results are not indicative of future returns. Any investment in the fund is considered high risk.

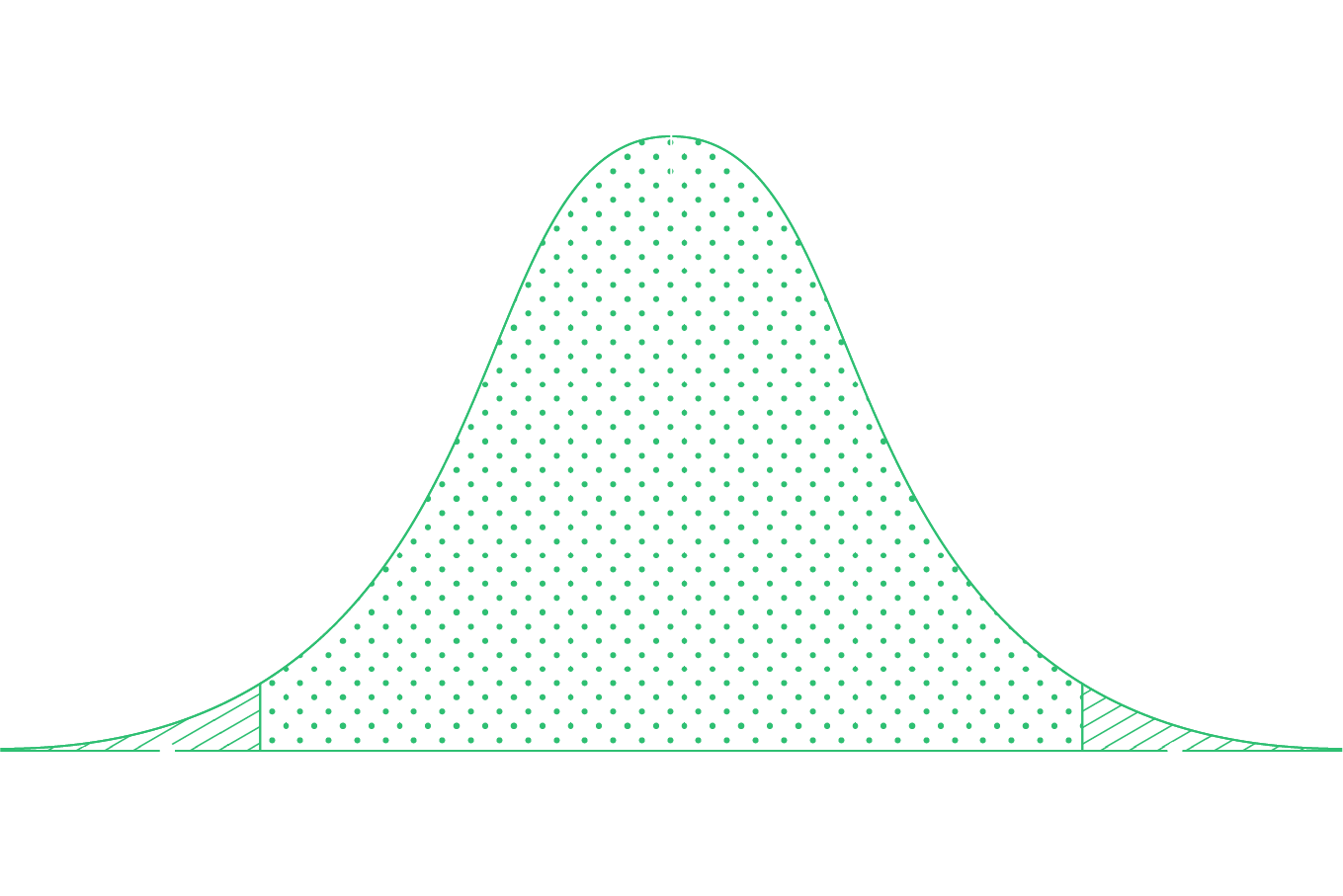

Body Risk

Patronus seeks to minimize body risk through active management and anticipating risks as they precipitate. Intraday we actively reduce parameters and movement risks utilizing our proprietary risk tools. Addressing risks in real-time and monitoring possible exposure reduces the variance and daily drawdown probabilities.

Tail Risk

Tail risk is addressed in three manners.

1. Patronus runs our proprietary simulation at the end of each day ensuring we meet a strict overnight gap risk limit.

2. Daily we adhere to internal risk boundaries calculated by our risk matrix. This acts as a VaR analysis over a broad set of scenarios.

3. Patronus has strict daily and monthly drawdown limits intended to secure investor capital in the event of a catastrophe. This gives our investors a defined expected limit that we anticipate to never breach in a black swan scenario.

Let's Work Together

Contact us to learn how Patronus Capital can connect you with more opportunity.